The Aug. 20 professionalism webinar, “In Times of Uncertainty, Professionalism Is Certain,” engaged the audience in a thoughtful discussion about how professionalism can help actuaries manage the uncertainties created by the COVID-19 pandemic and the resulting economic recession. As our presenters ran out of time to answer many of the audience questions during the webinar, they suggested that we answer some of them here.

Continuing Education

Will the Academy reduce the requirement to earn 6 hours of “organized” continuing education (CE) for 2020?

Because actuarial science is a constantly evolving discipline, meeting the Academy’s continuing education obligation is an essential component of actuarial practice in the United States, especially in these uncertain times. While social distancing practices aimed at decreasing the spread of COVID-19 have led to the temporary cessation of most in-person conferences or seminars, they have also increased the importance of maintaining continuing education by interacting with other actuaries. Consequently, the Academy has no current plans to relax the U.S. Qualification Standards (USQS) requirement that actuaries earn 6 hours of “organized” activity each year, which involves interaction with actuaries or other professionals working for different organizations. The good news is that you can get the needed “organized” activity CE by participating in live webinars where there is an opportunity to submit questions to the presenter. The Academy, as well as other actuarial organizations, regularly offer such events.

How far back should one keep documentation of compliance with CE requirements?

Section 6 of the USQS requires actuaries to keep records of their CE compliance for at least six years. These records should contain, at a minimum, the date of the CE, the credit hours obtained, and a brief description of the subject matter of the CE.

If an actuary recently became a member of one of the five U.S.-based actuarial organizations, when does that actuary need to comply with the requirements of the USQS? Does CE earned prior to becoming credentialed count toward this requirement?

Once an actuary becomes a member of any of the five U.S.-based actuarial organizations (not just the Academy), he or she must comply with all of the requirements of the USQS before issuing any Statement of Actuarial Opinion (SAO) to be relied upon in the United States. It is wise for candidates to plan ahead when they are close to qualification if they intend to issue SAOs shortly after receiving their credential.

CE earned during a calendar year typically qualifies the actuary for opinions issued during the subsequent calendar year. There are no CE “grace periods” for new members in the USQS. Section 2.2.4 specifies that an actuary may count hours earned before being credentialed, as long as the time was earned since the beginning of the prior calendar year. Section 2.2.2 further allows time spent in the current year to be “carried back” one year to make up for shortfalls, as long as the total 30 hours is earned before issuing an SAO. An example will clarify the implications of this (sections 2.2.2 and 2.2.4).

An actuary receives her first actuarial practice credential (in this example, becomes an Associate of the Society of Actuaries [ASA]) in July 2020. She meets the basic education and experience requirements to issue an SAO in October 2020. She wants to ensure her compliance with the CE requirement as well.

When calculating her CE hours, she is allowed to count all the hours earned in 2019, and in 2020 up until the date of the October 2020 opinion, in determining his qualification to issue that opinion. This time can be earned before or after her qualification, but not before 2019. As per section 2.2.7, time spent studying (reasonable allocated time) for relevant actuarial exams can also be included in this count as “Other Activities.” Time that this ASA spends in September 2020 studying for a fellowship exam can also be counted, even if the studying did not result in a passing grade (section 2.2.7).

However, any 2020 CE time that the actuary uses to qualify for her 2020 opinion cannot also be used for her 2021 opinions. She will need to earn another 30 hours of CE—normally during the remainder of 2020—to issue opinions in 2021.

ABCD

What proportion of alleged violations of the Code of Professional Conduct was brought to the attention of Actuarial Board for Counseling and Discipline (ABCD) by other actuaries?

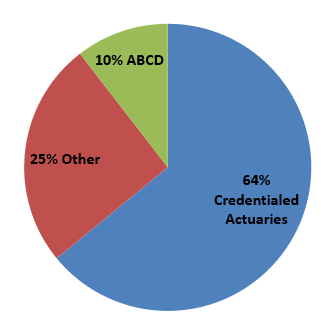

Between 2014 and 2019, the ABCD closed a total of 123 inquiries. One-quarter of those inquiries had been initiated by people other than credentialed actuaries. About 10 percent of ABCD inquiries were initiated by the ABCD itself, and 64 percent were initiated by credentialed actuaries.

Conflict of Interest

If two principals acknowledge a conflict of interest, can an actuary perform pricing or other services for each respective party where they may be on opposite sides of a transaction?

Precept 7 of the Code of Professional Conduct sets out what an actuary should do in such a case. First, the actuary’s ability to act fairly must be unimpaired. Second, the actuary must disclose the conflict of interest to both principals. Third, the principals must expressly agree to the performance of such actuarial services by the actuary. If any one of these three conditions is not met, the actuary may not perform the services.

Precept 10

With more business meetings going online, there is an increased temptation to “multitask” during meetings. Would such behavior be considered a violation with respect to Precept 10?

Precept 10 requires the actuary to perform actuarial services with courtesy and professional respect and to cooperate with others in the principal’s interest. It seems unlikely that occasional inattention during meetings, while rude and frustrating to other participants, would rise to the level of a Precept 10 violation. However, if the multitasking led to sloppy work and errors in the provision of actuarial services, this could constitute a Precept 1 violation. Precept 1 requires the actuary to act with integrity and competence and to perform actuarial services with skill and care.

When an actuary is handing off work to a successor actuary, can the actuary bill for time spent to prepare the information? Must the actuary provide data for which the actuary incurred costs to obtain? What about proprietary information that is important to gaining a full understanding of the work?

When a Principal has given consent for a new or additional actuary to consult with the Actuary, Precept 10 requires the actuary to cooperate in furnishing relevant information, subject to receiving reasonable compensation for the work required to assemble and transmit pertinent data and documents. So, yes, the first actuary can bill for time spent to prepare the information. On the second question, Precept 10 does require the actuary to provide the data, even if costs were incurred to obtain it. However, given that Precept 10 allows the actuary to bill for time spent preparing information, it may be reasonable for the actuary to request some sort of compensation for costs incurred for data that the actuary is now handing over to another actuary in the principal’s interest. With respect to proprietary information, Precept 10 states that the actuary need not provide any items of a proprietary nature, such as internal communications or computer programs. That said, the actuary should make sure information truly is proprietary before declining to supply it to the new actuary.

Documentation

Some may say that documentation is time-consuming. How would you respond to that?

Documentation may be time-consuming, but it is an essential part of providing actuarial services to a Principal. ASOP No. 41, Actuarial Communications, states that the actuary should consider retaining the supporting information that was not included in the report. In addition, ASOP No. 41 also says the actuary should consider retaining sufficient information for any recurring project so that another actuary could assume the assignment. Many new and recently revised ASOPs contain more detailed language on documentation, such as the following, from ASOP No. 56, Modeling:

The actuary should consider preparing and retaining documentation to support compliance with the requirements of section 3 and the disclosure requirements of section 4. If preparing documentation, the actuary should prepare such documentation in a form such that another actuary qualified in the same practice area could assess the reasonableness of the actuary’s work. The degree of such documentation should be based on the professional judgment of the actuary and may vary with the complexity and purpose of the actuarial services. In addition, the actuary should refer to ASOP No. 41, section 3.8, for guidance related to the retention of file material other than that which is to be disclosed under section 4.

That the Actuarial Standards Board believes documentation is important enough to include such language in every new and revised ASOP indicates the importance of documentation to the profession as a whole.