Proposed Revision of Deviation Language for All Standards and Removal of References to PSAOs from All Standards (All Practice Areas)

Proposed Revision of Deviation Language for All ASOPs

TRANSMITTAL MEMORANDUM

March 2008

TO: Members of Actuarial Organizations Governed by the Standards of Practice of the Actuarial Standards Board and Other Persons Interested in Actuarial Standards of Practice (ASOPs) (All Practice Areas)

FROM: Actuarial Standards Board (ASB)

SUBJ: Proposed Revision of the deviation language used for all ASOPs

This document contains the exposure draft of the proposed revision to the deviation language typically presented in section 4 of all Actuarial Standards of Practice (ASOPs) and the removal of references to Prescribed Statements of Actuarial Opinion (PSAOs) in all ASOPs. Please review this exposure draft and give the ASB the benefit of your comments and suggestions. Each written response and each response sent by e-mail to the address below will be acknowledged, and all responses will receive appropriate consideration by the drafting committee in preparing the final document for approval by the ASB.

The ASB accepts comments by either electronic or conventional mail. The preferred form is e-mail, as it eases the task of grouping comments by section. If you wish to use e-mail, please send a message to comments@actuary.org. You may include your comments either in the body of the message or as an attachment prepared in any commonly used word processing format. Please include the phrase “Deviation Language Revision Comments” in the subject line of your message.

If you wish to use conventional mail, please send comments to the following address:

Deviation Language Revision Comments

Actuarial Standards Board

1100 Seventeenth Street, NW, 7th Floor

Washington, DC 20036-4601

The ASB posts all signed comments received to its website to encourage transparency and dialogue. Unsigned or anonymous comments will not be considered by the ASB nor posted to the website. The comments will not be edited, amended, or truncated in any way. Comments will be posted in the order that they are received, based on the electronic timestamp or postmark. Comments will be removed when final action on a proposed standard is taken. The ASB website is a public website and all comments will be available to the general public. The ASB disclaims any responsibility for the content of the comments, which are solely the responsibility of those who submit them.

Deadline for receipt of responses in the ASB office: May 31, 2008

Background

The ASB recognizes that material on “deviation” is not uniform in all ASOPs. In order to achieve consistency, the ASB exposed language in September 2006 that was intended to be placed in each ASOP to uniformly address the “deviation” issue. As a result of the 16 comment letters that were received in response to this exposure draft, and its subsequent deliberation, the ASB has changed the guidance that was in the exposure draft. The ASB has also decided to take advantage of the pending revision of ASOP No. 41 to move the substantial guidance on deviation into ASOP No. 41.

The revised Qualification Standards, which became effective January 1, 2008, no longer refer to PSAOs. Therefore, the ASB has decided to remove all references to PSAOs at the same time.

Guiding Principles Regarding Deviation

1. The subject of deviation should be treated consistently.

2. The guidance on deviation should be in ASOP No. 41 (which is currently being revised) and appropriate references to the provisions in ASOP No. 41 should be added to each of the other ASOPs.

3. The ASOPs address how to comply with an ASOP while deviating from the guidance in the ASOP (as opposed to deviating from the ASOP).

4. Deviations fall into two distinct cases that require separate guidance:

a. The actuary must deviate from the guidance in the ASOP in order to comply with applicable law (which includes regulations and any other legally binding authority such as Statements of Financial Accounting Standards), or when a legally empowered party requires the actuary to use assumptions or methods that are not, in the actuary’s professional judgment, otherwise appropriate.

b. The actuary judges it appropriate to deviate from the guidance in the ASOP. This includes situations where the actuary agrees to deviate from the guidance when asked by a client or employer who is not legally empowered to require the actuary to do so.

Appendix 1 lists all existing ASOPs and indicates how each would be changed. There is no typical Appendix 2 discussing how comments were treated as this is a complete rewrite. Instead, Appendix 2 shows, as an example, the body of the exposure draft of ASOP No. 13 as it would be changed if this exposure draft is adopted.

Request for Comments

The ASB would appreciate comments on all areas of this proposed revision to all standards.

The ASB reviewed this proposed revision at the March 2008 meeting and approved its exposure.

Actuarial Standards Board

Stephen G. Kellison, Chairperson

Albert J. Beer Robert G. Meilander

Alan D. Ford James J. Murphy

Patrick J. Grannan Godfrey Perrott

David R. Kass Lawrence J. Sher

Sections to Appear in All ASOPs

1. The following would be inserted (usually to replace a similar paragraph) as the second paragraph in section 1.2, Scope:

If the actuary departs from the guidance set forth in this standard in order to comply with applicable law (statutes, regulations, and other legally binding authority), or for any other reason the actuary deems appropriate, the actuary should refer to section 4 regarding deviation.

2. Most ASOPs include a disclosure paragraph in section 4 (usually 4.1). If there is no disclosure paragraph the following stem will be inserted (numbering may be adjusted):

4.1 Disclosures—The actuary should include the following, as applicable, in an actuarial communication:

3. The following sections will be added to the disclosure paragraph (assumed to be 4.1. Note that letters x and y are variables dependent upon the number of subsections in paragraph 4.1 of each individual ASOP.)

4.1.x the disclosure in ASOP No. 41, section 4.2, if any material assumptions or methods were prescribed by applicable law (statutes, regulations, and other legally binding authority) or were selected under applicable law by a party other than the actuary; and

4.1.y the disclosure in ASOP No. 41, section 4.3, if the actuary otherwise deviated from the guidance of this ASOP.

4. All other deviation material will be deleted from section 4.

Sections to Appear in ASOP No. 41

Note the numbering of these sections will change if ASOP No. 41 (which is currently being revised) changes.

4.2 Certain Assumptions or Methods Not Selected by the Actuary

Where any material assumption or method was prescribed by applicable law (statutes, regulations, and other legally binding authority) or was selected under applicable law by a party other than the actuary, the actuary should disclose the following in the actuarial communication.

a. any assumptions or methods that were prescribed by applicable law or were set by another party pursuant to applicable law;

b. the applicable law that prescribed, or the party with legal authority that set, the assumptions or methods;

c. the purpose of the actuarial communication and, if appropriate, a statement that the content may be unsuitable for other purposes (for example, a tax reserve calculation pursuant to IRS regulations may not be suitable for some other purposes);

d. the following if either is the case:

1. the assumptions or methods significantly conflict with what, in the actuary’s professional judgment, would be reasonable for the purpose of the actuarial communication, or

2. the actuary did not evaluate the assumptions or methods for reasonableness for the purpose of the actuarial communication.

If the actuarial communication is in a prescribed form that does not accommodate these disclosures, the actuary should make this disclosure in a separate communication (such as a cover letter) to the principal requesting that both communications be disseminated together where practicable.

4.3 Deviation From the Guidance of an ASOP

If, in the actuary’s professional judgment, the actuary has deviated materially from the guidance set forth in an applicable ASOP, other than as covered under section 4.2, the actuary can still comply with that ASOP by providing an appropriate statement in the actuarial communication with respect to the nature, rationale, and effect of such deviation. The actuary should be prepared to explain the deviation to a principal, another actuary, or other intended users of the actuary’s communication. The actuary should also be prepared to justify the deviation to the actuarial profession’s disciplinary bodies.

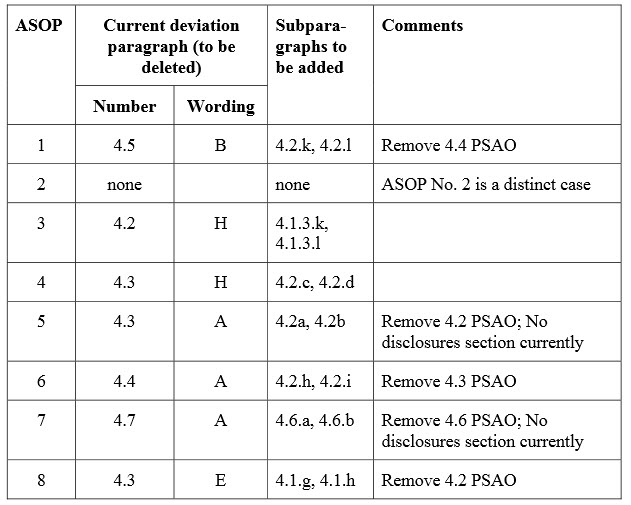

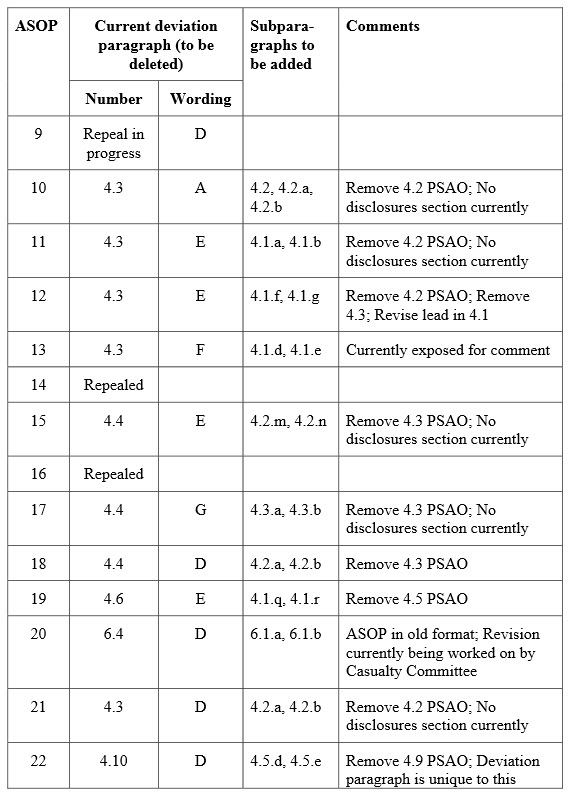

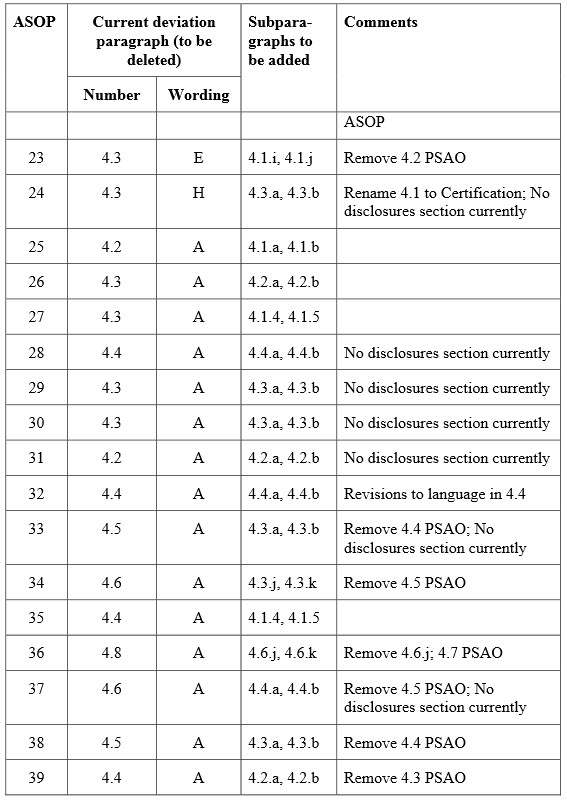

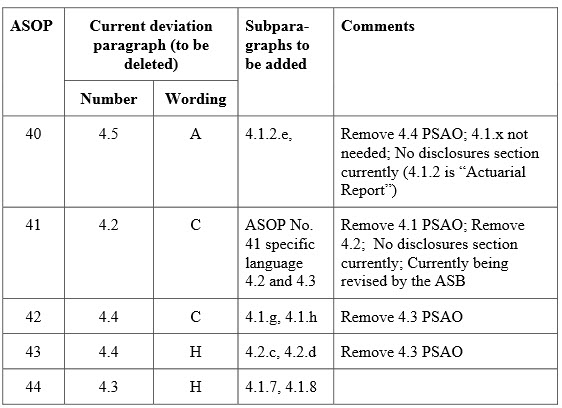

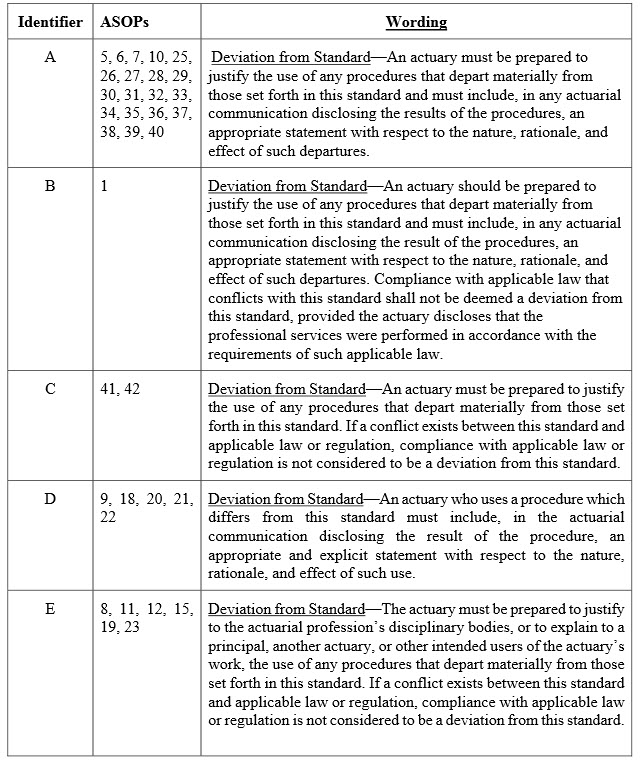

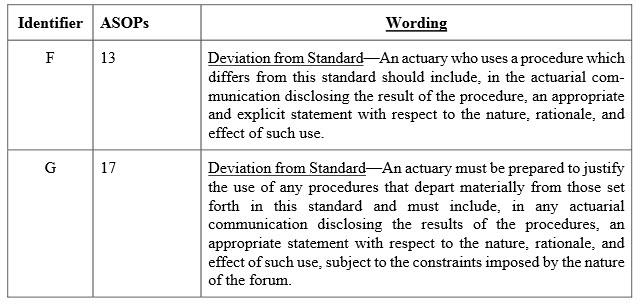

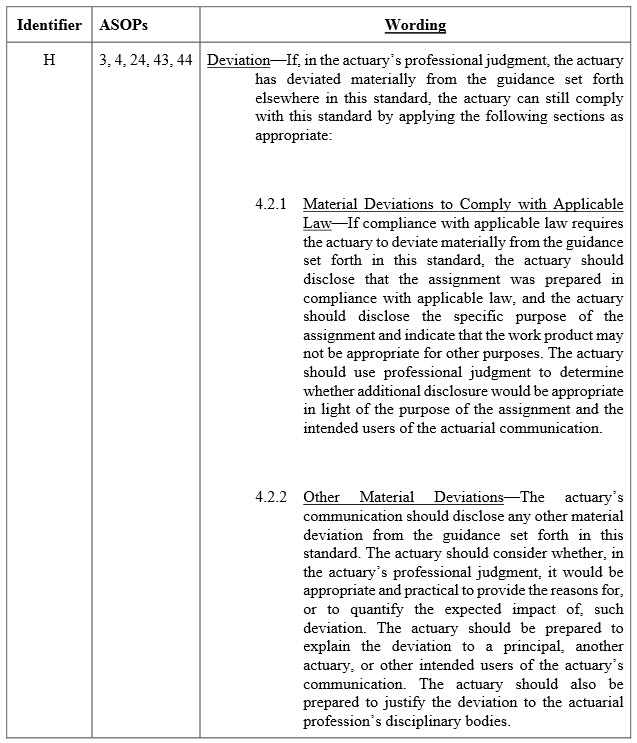

Appendix 1: Analysis of Current ASOPs

ASOP paragraphs affected by change in deviation language

This table shows for each ASOP the current deviation paragraph(s) in section 4, the actual wording (there are currently eight versions), where the new subparagraphs will be added, and any other comments. For this purpose changing the definition of applicable law is not deemed a material change.

Where there is currently no disclosure requirement the ASB will add a new paragraph. The numbering will be as shown in the following table.

At the same time the ASB plans to remove the PSAO language from any ASOPs that contain it as the concept of a PSAO is no longer relevant with the revision of the Qualification Standards effective January 1, 2008.

The revised ASOPs will include identification of these changes.

Existing Deviation Wording

——NOTE: EXAMPLE ONLY——

Using ASOP No. 13 Exposure Draft as an Example of How the New Deviation Language Will Be Implemented in Existing ASOPs

PROPOSED REVISION OF ACTUARIAL STANDARD OF PRACTICE NO. 13

TRENDING PROCEDURES IN PROPERTY/CASUALTY INSURANCE

STANDARD OF PRACTICE

Section 1. Purpose, Scope, Cross References, and Effective Date

1.1 Purpose

This actuarial standard of practice (ASOP) provides guidance to actuaries when performing professional services using trending procedures to estimate future values.

1.2 Scope

This standard applies to actuaries when performing professional services to estimate future values using trending procedures for all property/casualty coverages. This includes work performed for insurance or reinsurance companies, and other property/casualty risk financing systems that provide similar coverage, such as self insurance.

If the actuary departs from the guidance set forth in this standard in order to comply with applicable law (statutes, regulations, and other legally binding authority), or for any other reason the actuary deems appropriate, the actuary should refer to Section 4 regarding deviation The actuary should comply with this standard except to the extent it may conflict with applicable law (statutes, regulations, and other legally binding authority). If compliance with applicable law requires the actuary to depart from the guidance set forth in this standard, the actuary should refer to section 4.3 regarding deviation.

1.3 Cross References

When this standard refers to the provisions of other documents, the reference includes the referenced documents as they may be amended or restated in the future, and any successor to them, by whatever name called. If any amended or restated document differs materially from the originally referenced document, the actuary should consider the guidance in this standard to the extent it is applicable and appropriate.

1.4 Effective Date

This standard is effective for actuarial services performed four months after adoption by the Actuarial Standards Board.

Section 2. Definitions

The terms below are defined for use in this actuarial standard of practice.

2.1 Coverage

The terms and conditions of a plan or contract, or the requirements of applicable law, that create an obligation for claim payment associated with contingent events.

2.2 Experience Period

The period of time to which historical data used for actuarial analysis pertain.

2.3 Forecast Period

The future time period to which the historical data are projected.

The impact on insurance costs of societal changes such as changes in claim consciousness, court practices, and legal precedents, as well as in other noneconomic factors.

2.5 Trending Period

The time between the average date of the experience period and the corresponding date of the forecast period.

2.6 Trending Procedure

A process by which the actuary evaluates how changes over time affect items such as claim costs, claim frequencies, expenses, exposures, premiums, retention rates, response rates, conversion/issue rates, and economic indices. Trending procedures estimate future values by analyzing historical data and other relevant information.

Section 3. Analysis of Issues and Recommended Practices

3.1 Purpose or Use of Trending Procedures

The actuary should identify the intended purpose or use of the trending procedure. The actuary should apply trending procedures that are appropriate for the applicable purpose or use. Potential purposes or uses of trending procedures include, but are not limited to, ratemaking, reserving, valuations, underwriting, and marketing analyses.

Where multiple purposes or uses are intended, the actuary should consider the potential conflicts arising from those multiple purposes or uses and should consider adjustments to accommodate the multiple purposes or uses to the extent that, in the actuary’s professional judgment, it is appropriate and practical to make such adjustments.

3.2 Historical Insurance and Non-Insurance Data

The actuary should select data appropriate for the trends being analyzed. The data can consist of historical insurance or non-insurance information. Other considerations should include, but not be limited to, the following:

a. the credibility assigned to the data by the actuary;

b. the time period for which the data is available;

c. the predictive versus explanatory value of the data; and

d. the effect of known biases or distortions on the data relied upon (for example, the impact of catastrophic influences, seasonality, coverage changes, nonrecurring events, and distributional changes in deductibles, types of risks, and policy limits).

The actuary should consider economic and social influences that can have a significant impact on trends in selecting the appropriate data to review, the trending calculation, and the trending procedure. It is inappropriate to analyze only those factors that have an impact on trend in one direction. In addition, the actuary should consider the timing of the various influences.

3.4 Selection of Trending Procedures

The actuary should select trending procedures after appropriate consideration of available data. In selecting these procedures, the actuary may consider relevant information such as the following:

a. procedures established by precedent or common usage in the actuarial profession;

b. procedures used in previous analyses;

c. procedures that predict insurance trends based on insurance, econometric, and other non-insurance data; and

d. the context in which the trend estimate is used in the overall analysis.

3.5 Criteria for Determining Trending Period

The actuary should consider both the lengths of the experience and forecast periods, and changes in the mix of data between the experience and forecast periods when determining the trending period. When incorporating non-insurance data in the trending procedure, the actuary should consider the timing relationships among the non-insurance data, historical insurance data, and the future values being estimated.

3.6 Evaluation of Trending Procedures

The actuary should evaluate the results produced by each selected trending procedure for reasonableness and revise the procedure where appropriate.

3.7 Reliance on Data or Other Information Supplied by Others

When relying on data or other information supplied by others, the actuary should refer to ASOP No. 23, Data Quality, for guidance.

3.8 Documentation

The actuary should prepare and retain appropriate documentation regarding the methods, assumptions, procedures, and the sources of the data used. The documentation should be in a form such that another actuary qualified in the same practice area could assess the reasonableness of the actuary’s work, and should be sufficient to comply with the disclosure requirements in section 4.

Section 4. Communications and Disclosures

4.1 Actuarial Communication

When issuing an actuarial communication subject to this standard, the actuary should refer to ASOP Nos. 23 and 41, Actuarial Communications. In addition, the actuary should disclose the following, as applicable, in an actuarial communication:

a. the adjustments that the actuary considered appropriate in order to produce a single work product for multiple purposes or uses, if any, as described in section 3.1;

b. significant limitations in the data available, if any, which constrained the trending procedure used by the actuary such that, in the actuary’s professional judgment, there is a significant risk that a more in-depth analysis would produce a materially different trend estimate, as described in section 3.2; and

c. specific significant risks and uncertainties, if any, that might cause the actual trend to vary from the trend estimate.;

d. the disclosure in ASOP No. 41, section 4.2, if any material assumptions or methods were selected, under applicable law (statutes, regulations, and other legally binding authority), by a party other than the actuary or prescribed by applicable law; and

e. the disclosure in ASOP No. 41, section 4.3, if the actuary otherwise deviated from the guidance of this ASOP.

4.2 Additional Disclosures

In certain cases, consistent with the intended purpose or use, the actuary may need to make the following disclosures in addition to those in section 4.1:

a. When the actuary specifies a range of trend estimates, the actuary should disclose the basis of the range provided;

b. When the trend estimate is an update of a previous estimate, the actuary should disclose changes in assumptions, procedures, methods or models that the actuary believes might have a material impact on the trend estimate and the reasons for such changes to the extent known by the actuary. The actuary should consider whether, in the actuary’s professional judgement, it would be appropriate and practical to quantify the expected impact of such changes.

4.3 Deviation

If, in the actuary’s professional judgment, the actuary has deviated materially from the guidance set forth elsewhere in this standard, the actuary can still comply with this standard by applying the following sections as appropriate:

4.3.1 Material Deviations to Comply with Applicable Law

If compliance with applicable law requires the actuary to deviate materially from the guidance set forth in this standard, the actuary should disclose that the assignment was prepared in compliance with applicable law, and the actuary should disclose the specific purpose of the assignment and indicate that the work product may not be appropriate for other purposes. The actuary should use professional judgment to determine whether additional disclosure would be appropriate in light of the purpose of the assignment and the intended users of the actuarial communication.

4.3.2 Other Material Deviations

The actuary’s communication should disclose any other material deviation from the guidance set forth in this standard. The actuary should consider whether, in the actuary’s professional judgment, it would be appropriate and practical to provide the reasons for, or to quantify the expected impact of, such deviation. The actuary should be prepared to explain the deviation to a principal, another actuary, or other intended users of the actuary’s communication. The actuary should also be prepared to justify the deviation to the actuarial profession’s disciplinary bodies.

PDF Version: Download Here

Last Revised: March 2008

Document Status: Past Exposure Draft